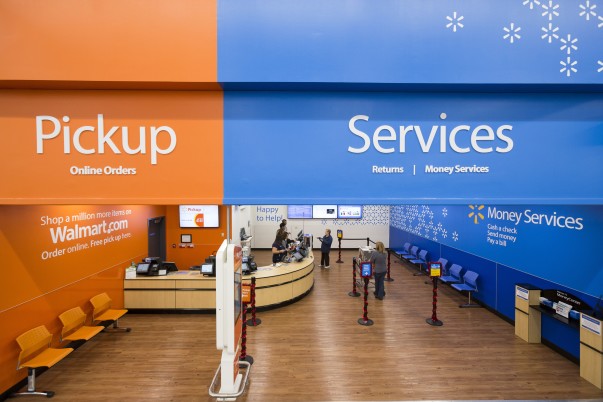

Six years ago, Walmex—a publicly traded subsidiary of Walmart Inc. and one of Mexico’s largest retailers and employers—was a very different company from the one it is today. Since 2017, Walmex has opened more than 400 new omnichannel stores, with home delivery, drive-through pickup areas, and in-store commercial kiosks where even customers who transact in cash can access online shopping.

Today, Walmex stands strong across metrics. Revenue in 2022 reached more than $40 billion and has grown at 8 percent per annum, with margins that have expanded each year. It has more than 1,000 stores with on-demand capabilities and more than 1,400 with in-store pickup services. The company’s media business, Walmart Connect, which was launched in 2019, offers physical and online advertising space and has become the fourth-largest media player in Mexico, with more than $100 million in revenue. The company’s telco and financial-services businesses have 7.8 million and 5.4 million total users, respectively.1

Walmex CEO Guilherme Loureiro, chief growth officer Beatriz Núñez, and former COO Cristian Barrientos (who is now CEO of Walmart Chile) say success hinged on a comprehensive transformation that required reimagining not just the company’s omnichannel strategy but also fundamental approaches to hierarchy, teamwork, and leadership. When the transformation began in 2017, Walmex’s more than 200,000 employees worked either in the 2,300-plus brick-and-mortar stores or in online sales, with only a few people dedicated to integrating the two channels. Because millions of customers across Latin America transact purely in cash, these customers were locked out of online shopping, which requires a credit or debit card.

As Loureiro observed digital challengers gradually creeping up on Walmex’s business, he knew the company would need to reinvent itself as an omnichannel enterprise to be ready for the future. But as they analyzed the scope of the challenge and the creativity and agility required to meet it, Loureiro and his fellow executives realized a cultural transformation had to happen first.

Before 2017, the company operated in silos, with a traditional hierarchical structure. The leadership style across these silos might best be described as “command and control,” Loureiro said. Digital talent and knowledge that developed within one silo tended to stay there, instead of permeating other parts of the company. To make the most of innovative people and ideas, the executive team sought to reorganize silos into entrepreneurial “squads” that could collaborate with one another. In some cases, fresh talent steeped in digital solutions needed to take the reins from longtime leaders whose expertise was old-fashioned retailing. Across the company, mentoring and coaching were deployed to help people assimilate the changes into how they worked.

Leading a cultural and operational transformation—while simultaneously pursuing results from the existing structure—demands courage, creativity, and flexibility from those in charge, as Loureiro, Núñez, and Barrientos can attest. They say the result—a delayered and customer-centric organization offering an omnichannel shopping experience—has been worth the deep and sometimes humbling introspection required. The three executives spoke with the McKinsey Quarterly to reflect on how they themselves had to transform in order to pursue this mission, providing a candid look at how a company reinvented itself.